[vc_row][vc_column width=”1/1″][vc_column_text]Framed Data raises $2M, 6Sense raises $12M, Reflektion raises $8M… The list goes on and on. What these companies have in common, aside from multi-million dollar investments, is that they are all in the market of predictive analytics. Predictive analytics is the art of making big data work by using past data to forecast future behavior. Who will churn? Who will buy what? Predictive analytics is at the core of Data Science.

Blue Yonder is one of those companies, and they just secured funding of $75 million from the global private equity firm Warburg Pincus . This is a unique deal in many respects. It was the biggest deal for a predictive analytics company in Europe and it was done by a PE firm, thus worth taking a second look – what is happening here?

I got an exclusive interview with Blue Yonder’s CEO Uwe Weiss (@WeissU). He explains that the market for predictive analytics is set for growth, how analytics meet transaction and why the future is in the automation of mass analytical decision in real time.

Read the full interview here or see below for the highlights and amazing insights of my interview with Uwe:

Analytics benefits the customer.

Predictive analytics provide customers with a number of benefits resulting in significant cost savings and operational efficiencies primarily based on accurate real time forecasts which enable automated decision-making such as demand forecasting, dynamic pricing, replenishment, churn prediction, and predictive maintenance. Industries benefitting from predictive analytics not only cover retail and consumer but also increasingly finance, travel, energy and manufacturing.

Automated analytics is the future of predictive analytics.

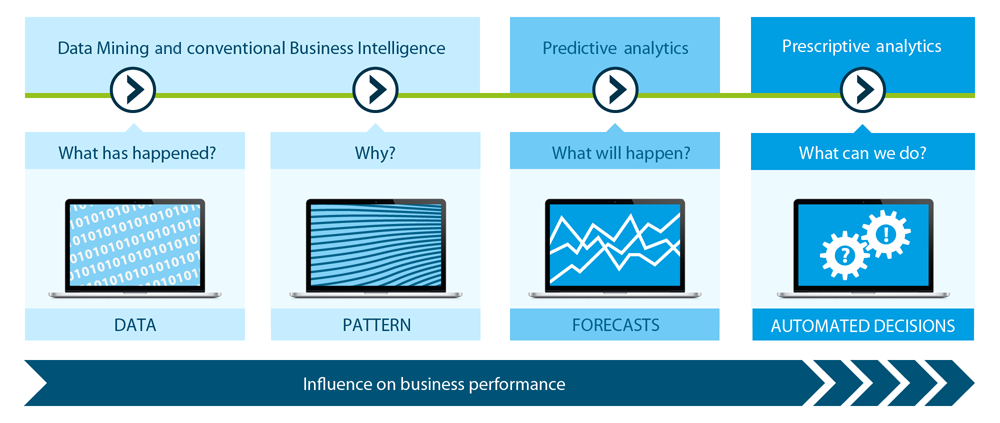

Three different kinds of analytics have been defined by Gartner: descriptive, predictive, and prescriptive. Descriptive analytics describe the analytics that have been around since the dawn of business analytics in the 1980’s, traditionally known as reporting with simple descriptive tools, such as frequency distributions, charts and graphs. Predictive analytics use models describing past data to predict future trends. Prescriptive analytics provide recommendations to front-line workers. Uwe believes that there is a fourth category, “automated analytics”. Tom Davenport recently postulated that automated analytics is a further extension to prescriptive analytics, eliminating the need for the human to action prescriptive analytics. So, instead of a middle man changing prices or determining what kind of marketing email to send to their client base, it can be done through applications. Uwe believes that “ 99 percent of automated business decisions can be automated . If you automate business decisions, you need predictive analytics.” (read quote)

The predictive analytics market is established and growing.

The market for predictive data is forecast to grow at a compound annual growth rate of 34% from 2012 to 2017 reaching $48 billion, according to Gartner. Venture capitalists were quick to make early-stage investments into predictive analytics offerings. Uwe believes that any new startups in this space have to show how they are different in order to break into this already growth market. “The technology is at the plateau of productivity. People can use this technology now and produce ROI.” (read quote) Uwe believes that this is because the need for predictive analytics is fairly independent from traditional economic cycles. This view is matched by Gartner. Already in 2012 they predicted that predictive analytics technology is in a mature state. It is the lifeblood of a real-time enterprise and no longer an art in a “dark corner”. Working under these assumptions, it has become logical that Uwe sees the opportunity for a bigger enterprise software play. The time of predictive analytics being in a corner is over… Let’s go for scale.

Let’s go for scale!

But hold on? Scale? So far, we see a lot of players offering niche expertise in one specific area such as churn management or marketing segmentation. Why? Because solutions are built around specific domain knowledge. The impact of domain knowledge in Data Science is often discussed; at the Strata conference in 2012, there was a lot of discussion over whether domain knowledge is important or can be solved by brute force. Senior experts in this domain such as Monica Rogati (@mrogati) and Xavier Amatriain (@xamat) from Netflix showed why domain knowledge is very important.

As Uwe explains, one can “build their software architecture around their domain.” The advantage is clear: “you can run very fast and catch a lot of market share” in doing this. (tweet this )

Uwe believes that is dangerous to remain in only one domain. “We go for the broader perspective and we have seen that we can – with our people and our engineering – tackle more domains and add domain knowledge relatively easily.” (read quote) He has geared Blue Yonder towards handling the bigger questions first – data digestion, time series management, and the handling of diverse machine learning algorithms. This generic-built predictive applications architecture allows Blue Yonder to integrate vague domain specialities into their platforms very rapidly. Thus, instead of software architecture being built around their domain, they are bringing domains into their software architecture.

Okay – I get it now. This is the new accord. This technology has reached the plateau of productivity . The market looks for an enterprise ready platform that can scale by incorporating domain knowledge, one domain at a time… And that’s why a private equity firm has invested in Blue Yonder and into the area of predictive analytics.

Predictive analytics is stable against economic cycles and will continue to grow fast.

Uwe points out one more reason why a PE firm would be looking to make such an investment. Predictive analytics is stable against economic cycles. “People buy food. People go to restaurants. People use trains and buy tickets, and so predictive analytics will have their space. The fundamental belief [of predictive analytics] and potential for explosive growth is responsible for private equity entering this area.” Even in an economic downturn, predictive analytics embedded into critical enterprise processes such as pricing, replenishment, logistics, and supply chain yield management will be cost-effective. Predictive analytics will always be needed and indeed the market opportunity here is huge.

When asked to comment on this investment, Joseph Schull, a Managing Director at Warburg Pincus, commented that “the transformation of Big Data into actionable information is at the high growth frontier of enterprise IT . Our investment in Blue Yonder is the result of an extended, international search for the opportunity to participate in this major new wave and growth opportunity.” It is now clear that Warburg Pincus invested in their fundamental belief in the hyper-growth of this market.

With all of the excitement and development in the predictive analytics market, what’s next for Blue Yonder? What will the $75 million investment enable them to do?

“We want to place our bets on the right areas, so America is definitely the next step on our internationalization roadmap.” (read quote) Even with the geographic expansion, Blue Yonder will continue to expand on the enterprise software level. “Product-wise, we will focus on the domains we have defined for ourselves. This gives us a lot to do for the next 24 months. I am convinced that we will see a mass market for predictive applications from 2016 onwards. All of the global 2000 Leading Companies in all relevant industries will need to adapt and use it . ” (read quote)

Thus, the prediction about predictive analytics is that there is more to come. Stay tuned – and subscribe to my newsletter to learn more about Big Data and why we actually want Small Data! The full interview can be read here at LutzFinger.com

(republished from my original FORBES article)[/vc_column_text][/vc_column][/vc_row]